Quarterly Money Market Fund Commentary

March 31, 2025

Cash Management Portfolios

What market conditions had a direct impact on the bond market this quarter?

Economic Activity – Following a strong 2024, U.S. economic growth slowed throughout the first quarter of 2025 (Q1) as consumer and business sentiment weakened sharply amid the disjointed rollout of new policies by the Trump administration. U.S. Gross Domestic Product (GDP) is projected to grow near 0.5% for Q1 and remain subdued over the balance of the year as rapidly changing tariff policies and escalating trade tensions weigh on growth prospects. Personal consumption eased from the robust pace in 2024, but the sharp deterioration in sentiment has yet to flow-through to actual spending levels, with consumers continuing to benefit from growing real wages and still-high household wealth. Labor markets remain resilient, with hiring activity keeping pace with labor force growth and layoffs remaining low. February U.S. job openings declined to 7.6 million open positions, while total unemployed workers in the labor force as of March were marginally higher at 7.1 million. Monthly Non-farm Payrolls (NFP) growth continues to ease but remains healthy, averaging 152,000 during Q1 and the U3 Unemployment Rate was 4.2% in March. Average Hourly Earnings growth is off its highs but remains solid at 3.8% year-over-year (YoY). U.S. inflation readings remained above the Federal Reserve’s (Fed) 2% target in Q1 but showed positive progress late in the quarter. The Consumer Price Index (CPI) declined to 2.4% in March versus 2.9% in December, reflecting a sharp drop in energy prices. Core inflation also improved with CPI ex. food and energy rising 2.8% YoY for March as core services prices gradually ease. The Fed’s preferred inflation index – the PCE Core Deflator Index – increased 2.8% YoY for February. The path back to the Fed’s inflation target remains elusive as goods inflation, which had detracted from inflation, is projected to be a headwind given the expected impact of tariffs on goods prices.

Monetary Policy – The Fed left its federal funds target range unchanged during the quarter at 4.25% to 4.50%. The Fed’s post-meeting statement was updated to remove reference to risks being roughly in balance and instead stated that “uncertainty around the economic outlook has increased." While Fed Chair Powell said no signal was meant by the change and noted economic data had not reflected the impact of tariffs, risks for weaker employment and higher inflation have increased in light of recent tariff announcements. The Fed slowed the pace of its balance sheet reduction program (quantitative tightening), with the monthly cap on Treasury securities lowered from $25 billion to $5 billion. The monthly cap on agency mortgage-backed securities was left unchanged at $35 billion, however, this is non-binding as monthly principal payments have yet to reach this level.

The Federal Open Market Committee (FOMC) released its updated Summary of Economic Projections at the March meeting, which continue to suggest 50 basis points (bps) of rate cuts in 2025 with the median projection for the federal funds rate in a range of 3.75% to 4.0% at year-end. The median dots show further rate cuts of 50 bps in 2026 and 25 bps in 2027, and the estimated longer-run neutral rate was unchanged at 3.0%. The FOMC’s economic projections were revised to show higher expected core inflation (2.8% versus 2.5%) and unemployment rate (4.4% versus 4.3%) in 2025 and a lower GDP growth forecast for 2025-2027 compared to the prior release.

Fiscal Policy – Q1 saw a whirlwind of fiscal policy action. The federal government once again narrowly avoided a shutdown in March with Congress passing a continuing resolution to fund government operations at existing spending levels through September. Congress is preparing legislation to permanently extend the 2017 tax cuts while providing additional tax cuts. Legislation will also address added spending for defense, immigration, and border control, raising the debt limit by as much as $4 to $5 trillion, and identifying spending cuts to fund a portion of the tax cuts. Legislation is expected to come sometime in May. At this point, no legislation has been passed raising the federal debt ceiling limit which is expected to be reached in the third quarter.

The quarter was highlighted by a flurry of tariff announcements culminating with “Liberation Day” on April 2 which included a baseline 10% tariff on all imports and “reciprocal” tariffs on dozens of countries that have trade deficits with the U.S. As of this writing, the Trump administration has suspended reciprocal tariffs for 90 days while increasing tariffs on China to 145%. Tariffs on steel and aluminum, automotives, and non-USMCA-compliant goods from Canada and Mexico remain in effect with further sectoral tariffs expected over the near-term, including semiconductor chips and pharmaceuticals. The implementation of expansive tariff policies will serve as an economic headwind moving forward, with expectations for lower growth and higher inflation for the balance of the year. The municipal sector is facing growing headwinds to finances including rising demand for local funding, evaporation of federal COVID money, and unknown impacts from tariffs on economic activity. Fortunately, municipal revenues have remained solid to this point and reserves remain strong.

Credit Markets – The first quarter’s meaningful decline in U.S. Treasury yields was driven by disappointing economic data and a subsequent increase in the number of Fed rate hikes expected in 2025. Yields traded in a tight range versus year-end 2024 levels, offering opportunities to lock in yields at attractive levels. Yield declines occurred in the second half of the quarter as economic data began to deteriorate. Q1 yield drivers became stale following the Trump administration’s “Liberation Day” tariff announcements on April 2, which sparked severe market volatility and reduced consumer and investor confidence..

Yield Curve Shift

|

U.S. Treasury Curve |

Yield Curve 12/31/2024 |

Yield Curve 3/31/2025 |

Change (bps) |

|---|---|---|---|

|

3 Month |

4.314% |

4.294% |

-2.1 |

|

1 Year |

4.143% |

4.020% |

-12.3 |

|

2 Year |

4.242% |

3.883% |

-35.8 |

|

3 Year |

4.273% |

3.874% |

-39.8 |

|

5 Year |

4.382% |

3.950% |

-43.2 |

|

10 Year |

4.569% |

4.205% |

-36.4 |

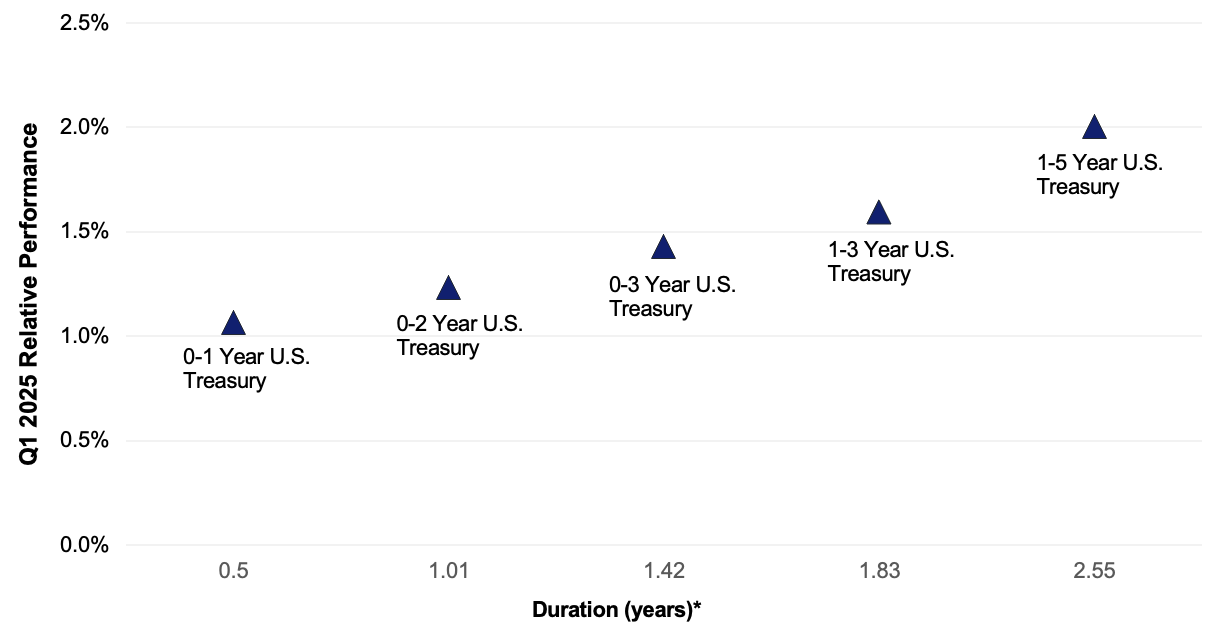

Duration Relative Performance

*Duration estimate is as of 3/31/2025

The three-month to ten-year portion of the yield curve re-inverted, as 10-year yields fell 36.4 bps with three-month yields falling only 2.1 bps on no changes to Fed rate policy in the quarter. As expected in a falling rate environment, longer duration strategies outperformed their shorter duration counterparts.

Credit Spread Changes

|

ICE BofA Index |

OAS* (bps) 12/31/2024 |

OAS* (bps) 3/31/2025 |

Change (bps) |

|---|---|---|---|

|

1-3 Year U.S. Agency Index |

4 |

3 |

-1 |

|

1-3 Year AAA U.S. Corporate and Yankees |

14 |

9 |

-5 |

|

1-3 Year AA U.S. Corporate and Yankees |

30 |

28 |

-2 |

|

1-3 Year A U.S. Corporate and Yankees |

49 |

51 |

2 |

|

1-3 Year BBB U.S. Corporate and Yankees |

75 |

80 |

5 |

|

0-3 Year AAA U.S. Fixed-Rate ABS |

38 |

50 |

12 |

Option-Adjusted Spread (OAS) measures the spread of a fixed-income instrument against the risk-free rate of return. U.S. Treasury securities generally represent the risk-free rate.

Corporate credit spreads were relatively stable in the quarter. BBB corporates underperformed their AAA-A rated counterparts as the incremental yield from BBBs could not overcome the extra widening of BBB credit spreads versus higher rated credit. Underperformance in the ABS sector was an outlier versus other spread sectors, as ABS credit spreads widened 12 bps on growing concerns over U.S. consumer health.

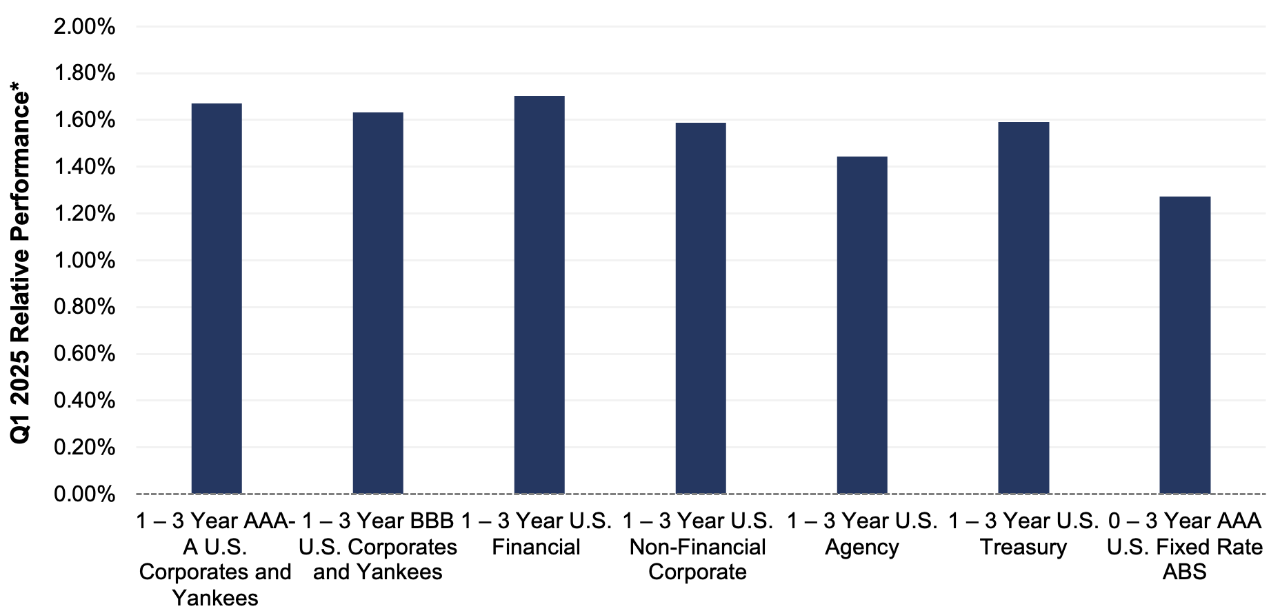

Credit Sector Relative Performance of ICE BofA Indexes

*Data is as of 3/31/2025

ICE BofA Index

*AAA-A Corporate index outperformed the Treasury index by 7.9 bps.

*AAA-A Corporate index outperformed the BBB Corporate index by 3.8 bps

*U.S. Financials outperformed U.S. Non-Financials by 11.7 bps

The sharp decline in yield curve levels generated strong absolute performance for all fixed income sectors. Given relatively uniform yield declines for two-year and longer maturities, along with mild credit spread changes in the quarter, performance dispersion among most sectors was muted. AAA-rated ABS was the outlier, as widening ABS spreads drove underperformance in the sector.

What were the major factors influencing money market funds this quarter?

The first quarter of 2025 saw a reluctant Fed pause its easing cycle and hold rates in the 4.25% to 4.50% range. With labor and inflation data somewhat firm, and economic data softening, market expectations for the Fed moved a bit dovish, indicating three 25 bps cuts by year-end. There are varying opinions on the timing and pace of future rate activity, and ultimately, the Fed has stated decisions will remain data dependent. The challenge for managers going forward will be determining how the economic, inflation and employment data will influence FOMC action. Industry-wide, money market fund assets trended higher during the quarter as short-term yields continue to attract investors. Money market funds remain a viable option relative to other short-term cash equivalent options.

First American Prime Obligations Funds

Given the current rate environment, credit conditions and trading ranges appear stable. Given the yield curve and our conservative cash flow approach, the First American Funds were positioned with strong portfolio liquidity metrics influenced by Fund shareholder makeup. We continued to employ a heightened credit outlook, maintaining positions presenting minimal credit risk to the Fund’s investors. During the first quarter, our main investment objective was to prioritize liquidity while opportunistically enhancing portfolio yield, with a combination of fixed and floating rate securities, based on our economic, credit and interest rate outlook. We believe the credit environment and higher relative fund yields make the sector an appropriate short-term option for investors.

First American Government and Treasury Funds

As the Fed maintains a more cautious approach, money market funds remained defensive, positioning to preserve yields with the rising possibility of falling rates. Managers extended durations, investing in longer term securities to get ahead of a forecasted lower yield environment. With Quantitative Tightening and increasing U.S. debt needs, Treasury supply remained plentiful, putting marginal upward pressure on repo and secured overnight financing rate (SOFR) yields. These market dynamics support a more barbell investment strategy. For money market fund investors, extension into lower yielding long-term securities puts marginal downward pressure on portfolio yields. However, the slowing pace of Fed activity and relatively flat yield curve should mute the downward pressure on front-end rates and ultimately should slow the decline in money market fund yields. Strategically, when presented with appropriate value, managers purchased floating-rate investments anticipated to benefit shareholders over the securities holding period. Our investment strategy will be fluid in the coming quarters as markets make determinations on the Fed’s comfort level with inflation, economic growth and ultimately, the timing and pace of future Fed policy action.

First American Retail Tax Free Obligations Fund

Tax free money fund yields were choppy throughout the quarter. The volatility can largely be attributed to resets on variable rate demand notes (VRDNs). SIFMA, an index comprised of 7-day VRDNs, traded in a wide range of approximately 180 bps. The lowest levels were experienced in early January and early February when strong reinvestment demand from municipal bond maturities and coupon payments overwhelmed available supply. At times, resets were simply too aggressive relative to taxable investment alternatives. And subsequently, as broker dealer inventories swelled, big spikes in SIFMA were required to motivate marginal and non-traditional buyers. The weighted average maturity (WAM) of the Fund was maintained at roughly 30 days. Similar to recent quarters, we continued to look to position the portfolio with higher allocations to fixed-rate securities and longer WAMs versus competitor averages.

What near-term considerations will affect fund management?

Industry wide, we anticipate that prime fund yields will gradually decline as managers roll maturities into lower yielding securities that are pricing in future rate cuts. However, broadly speaking, front-end yields in credit securities should continue to benefit from the overall supply of Treasury securities. Modest spread widening, as well the impacts of a smaller prime money market fund universe, should create competition among credit issuers for the marginal dollar and support yields. Based on our market outlook and breakeven analysis, we will seek to capitalize on investment opportunities that make economic sense in the coming quarters. We believe the Institutional and Retail Prime Obligations Funds will remain reasonable short-term investment options for investors seeking higher yields on cash positions while assuming minimal credit risk.

Yields in the government-sponsored enterprise (GSE) and Treasury space will decline in concert with additional anticipated Fed rate cuts. As with non-government debt, government and Treasury fund yields will continue to gradually decline as managers roll maturities into securities with lower yields that are pricing in future rate reductions. Managers will defend against future cuts by extending to optimal spots on the curve relative to Fed rate forecasts, policy impacts and market volatility. We anticipate some moderate yield dislocations in Treasury, GSE and repo issues as Treasury supply fluctuates. We note that with the failed/delayed extension of the debt ceiling, extraordinary measures have been implemented, which will reduce Treasury bill supply until a resolution is reached. A supply decrease in Treasury bill issuance will put temporary downward pressure on Treasury bill and repo yields, and ultimately Government and Treasury money market funds. However, in general, with a resolved/extended debt ceiling policy and the continuation of quantitative tightening, Treasury bill and repo levels should rebound. Any large supply changes in Treasury issuance may create yield volatility and ultimately opportunities on the front end as the forces of supply and demand seek optimization. We will continue to seek value in all asset classes and exploit market conditions that support domestic and global economic outlooks.

For more information about the portfolio holdings, please visit

https://www.firstamericanfunds.com/index/FundPerformance/PortfolioHoldings.html

Sources

Bloomberg

https://www.federalreserve.gov/monetarypolicy/files/monetary20250129a1.pdf

https://www.federalreserve.gov/monetarypolicy/files/monetary20250319a1.pdf

https://www.federalreserve.gov/monetarypolicy/files/fomcprojtabl20250319.pdf

https://taxfoundation.org/research/all/federal/trump-tariffs-trade-war/

https://news.bgov.com/bloomberg-government-news/bgov-bill-analysis-h-con-res-14-bicameral-budget-plan